By Elsante Mnzava

The writer work with the CEO & Founder of BiasharaWorks (www.biasharaworks.com), a Mkenga Group Limited subsidiary. Email: emnzava@mkenga.com

We all recognize that Enterprise Resource Planning platforms (ERP) like SAP, Oracle, Sage and the like do an excellent job of driving accounting, validating the journal entries, sub-ledger tie-outs and other complex transactional information. Yet, they fall short in one critical area: they don’t validate this data for the financial close.

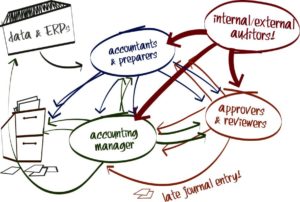

As a consequence, finance and accounting teams manually address this, often using complicated, multi-line spreadsheets. Indeed, as depicted in Figure 1, the various processes involved in closing the books, reconciling intercompany transactions and tracking key finance controls are just as complicated and as manual as they were a generation ago.

Figure 1: The current financial close process is messy and complicated

Enter a unified cloud platform from Blackline (www.blackline) which was recently introduced to Ghana through a partnership with BiasharaWorks, a subsidiary of Tanzania-headquartered Mkenga Group Limited.

Enter a unified cloud platform from Blackline (www.blackline) which was recently introduced to Ghana through a partnership with BiasharaWorks, a subsidiary of Tanzania-headquartered Mkenga Group Limited.

Founded in 2001, BlackLine is a web-based application that aids accounting professionals with the financial close management processes, specifically around balance sheet account reconciliations. It provides simple, secure and automated tools that take data extracts from any ERP system (for example, it easily integrates with SAP and Oracle both of which are widely used by leading companies in Ghana).

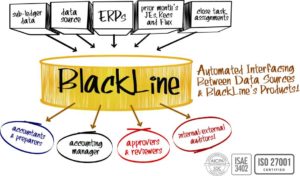

The ease of integration through API allows users to send data from their ERP to Blackline as well as from Blackline to their ERP. Per Figure 2, the system is truly ERP and system agnostic in that it supports files from any single system, from multiple systems in use, and from third parties on your behalf. In addition, for companies with multiple systems and complex needs, it can connect with any number of general ledger systems simultaneously, resolving many of the issues associated with consolidating data across systems.

Importantly, Blackline has over 1200 companies using its platform to close their books. These include companies like Shell, Johnson & Johnson, Merck, Mylan, Dow, Cox, Boeing, Lafarge, Westinghouse etc., who have used Blackline to complement their ERPs as well as automate and standardize account reconciliation processes to gain complete control and visibility. Moreover, BlackLine’s customers have no boundaries; they are big and small, span international borders and operate across all industries.

Figure 2: Blackline pulls data from any of your financial platforms and data sources

So what are the advantages of BlackLine? In short, Blackline delivers unprecedented efficiency, speed, visibility, reduced cost with an eye toward delivering a risk-controlled financial close. Here is how we see the advantage in more detail.

So what are the advantages of BlackLine? In short, Blackline delivers unprecedented efficiency, speed, visibility, reduced cost with an eye toward delivering a risk-controlled financial close. Here is how we see the advantage in more detail.

Risk Management & Fraud Prevention:

Reduce risk and ensure financial accuracy with automated flux analysis, exception handling, and dynamic risk ratings for all accounts. Ensure that every single account, journal entry, or process step is properly completed and attested to by multiple individuals.

Compliance & CAMA:

Build repeatable, testable, audit-ready practices that enforce your company policies for daily operations and the month-end close. Embedded controls, automated data entry and mandatory reviews / approvals ensure that you can cease to worry about being cited for material weaknesses.

Visibility:

Monitor and manage your daily operations, audits, and the financial close with real-time reports and dashboards. Additionally, drill-down capability allows you or your managers to quickly view work done by a single entity, department, team or user.

Streamline & Automate:

Scale your accounting operations without additional resources. Automate your journal entries, high volume transaction matching, and balance sheet account reconciliations.

Build a Better Process:

Transform your financial close with an automatic workflow approval process, email alerts, and the ability to schedule and track system and human tasks. Reduce or eliminate error-prone spreadsheets and the binders, boxes, and storage rooms in which they reside.

Blackline is rapidly becoming the de-facto standard for Accounting and Finance departments across companies of all sizes. It replaces manual, error-prone, excel-based financial close with Automation, Control and Visibility.