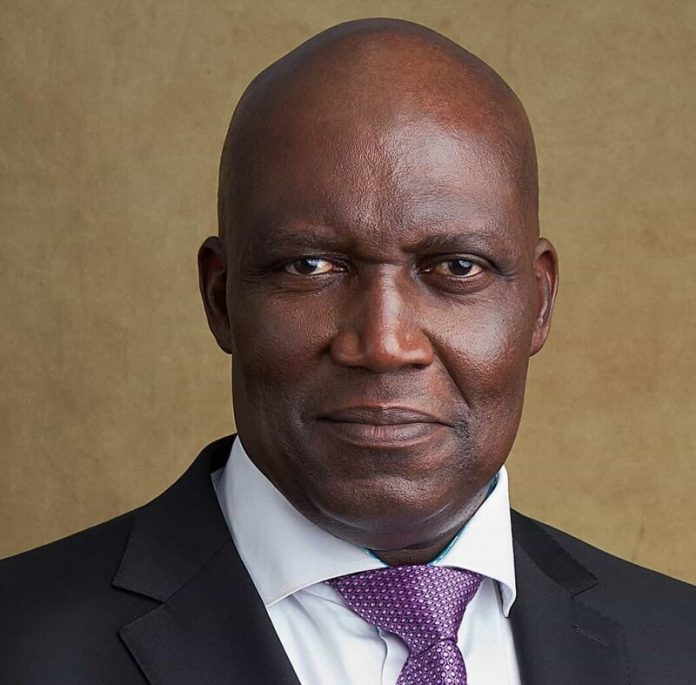

DALEX Finance, a formidable Ghanaian Finance Company is on a war path. For the past few weeks, the company led by its CEO, Mr. Kenneth Thompson and Director of Strategy, Mr. Joe Jackson has been venting their frustrations with what they call ‘the injustice of Ghana’s Financial Sector’ on Social Media and Radio.

In a radio interview last week on the Citi Breakfast Show, Mr. Kenneth Thompson intimated; “…there is an injustice in the finance sector that has persisted for decades. It has gone on for so long, it feels like a non-issue now. It has become part of the status quo and people have accepted it as normal.

This is a system that provides security with one hand and denies sharing of returns with the other hand. This is a system which allows the banks to collect deposits, lend it to the Government of Ghana (they buy treasury bills) or to their customers at up to 35% per annum and at the end of the month, charge their customers for the privilege of keeping their money and pay most of them nothing (most banks pay less than 5% on savings account and nothing on current accounts) or a few some coins at best!”

“It’s an insult to say Ghanaians are greedy, everybody wants good returns on their hard-earned cash!” Mr. Kenneth Thompson also passionately shared this viewpoint in the interview, pointing towards the reality that banks can do better by their customers, if they want to. With that in mind, it’s quite sad that for decades, Ghanaians have settled for next to nothing from the financial institutions that they save with. The massive financial sector crisis and clean-up added fuel to the fire of this injustice and now people feel it’s more than enough to settle for just ‘safe’.

The truth is, four years after the sector clean-up, the Bank of Ghana is exercising much tighter control over the financial sector. Efforts to restore faith in the security of the financial system are important because confidence in the financial sector is key to its development. The SME sector is the engine of growth, and growth can only be possible if there is a viable financial sector to support SME’s to deliver prosperity and create jobs.

Fortunately, some financial institutions offer safety, as well as high returns on your money. DALEX FINANCE has been one of the most credible players in Ghana’s financial sector, since 2006. DALEX SWIFT, from DALEX FINANCE, is a mobile phone-based investment product that gives all the safety of a bank, with much better interest rates, as much as 16%! DALEX Finance is regulated by the Bank of Ghana so there’s the triple reward of safety, peace of mind and high returns for everyone who chooses to invest with DALEX SWIFT. Now, that’s way better than your bank.

With added perks like no charges on any transactions, wholly digitised systems for customer convenience and full transparency on all operations; it’s safe to say that Ghanaians don’t have to settle for just safe anymore.

thebftonline