By Christopher M. Naghibi

Chris Naghibi believes that one should not rush with the decision to buy a home before checking off the three most essential things. Here, he talks about each in detail.

Getting a trusted realtor

Realtors snag a cut from the sales price of a house. Naghibi says that this is why some buyers hesitate to have a realtor: they think it will crank up the overall cost. Naghibi reminds everybody that the seller, not the buyer, dispenses the commission. “It’s important to know that the agent who represents the seller does not protect the buyer’s interest,” says Naghibi. So the agent would simply pocket commission from both sides. This means the buyer won’t save money. That’s where a savvy realtor comes in who’d protect the buyer’s interests and guide her through the entire buying process – from negotiating a favorable price to carrying out a proper home inspection.

Keeping track of credit score

Naghibi recommends potential buyers be aware of their credit scores before even attempting to sign up for a loan. They should take steps to improve the score if it is below 699. A good credit score means the buyer can get a loan at a low-interest rate, saving the buyer thousands of dollars over the loan’s time frame.

Getting exactly what one wants

Naghibi recommends buyers take the time to jot down the features, floor plans, and style of the house they are looking for. He also advises considering the kind of neighborhood and other key elements to arrive at the best possible purchase.

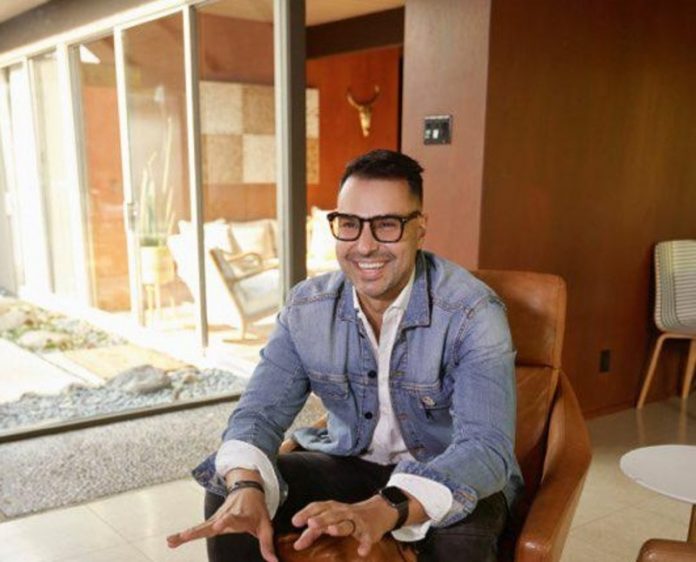

Christopher M. Naghibi is the founder and Chief Executive Officer of Black Crown Inc. He is known for his strong credit skills and broad experience in dealings with real estate. Looking at Naghibi’s excellent track record in real estate, it’s worth latching onto his advice.