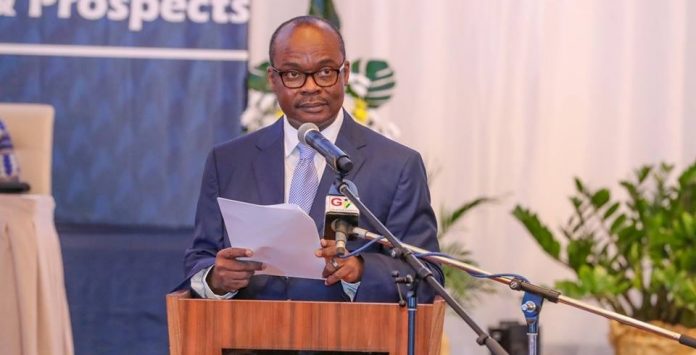

Governor of the Bank of Ghana, Dr. Ernest Addison, has said the Monetary Policy Committee (MPC) is pondering the possibility of revising the bank’s medium-term inflation target, which currently stands at 8±2 percent.

Announcing a new monetary policy rate, the Governor said having brought inflation down from 15.4 percent as at end 2016 to 9.4 percent in December 2018, within its target range, the central bank believes it could do better – hence it is considering lowering the target.

Data from the Ghana Statistical Service (GSS) has shown that the 9.4 percent inflation recorded last December is the sixth consecutive month of single-digit inflation – meaning that the annual average movement of prices of goods and services has remained below 10 percent since July last year, well within the central bank’s range.

But speaking yesterday at the BoG’s office in Accra, Dr. Ernest Addison said the bank is already looking beyond its current target.

“I think we all agree that, maybe, this is the time to relook at the new central point; whether the 8±2 percent should continue to remain the next medium target for inflation, or if we could move it further downward toward a lower rate of inflation.

“Our trading partners have inflation rates below 5 percent and closer to 2 percent – if you have a higher inflation, just from the inflation differential, you lose competitiveness. Yes, there might be a need to relook at the medium-term inflation target we have set for ourselves in order to maintain competitiveness of the Ghanaian economy,” the Governor said.

Dr. Addison further attributed the Monetary Policy Committee’s decision to reduce the policy rate by 100 basis points to 16 percent to subdued inflation, which poses no immediate challenge to the BoG’s forecast.

“The Committee noted that inflation has steadily declined, from 15.4 percent at the end of 2016 to 11.8 percent in 2017 and further down to 9.4 percent in 2018, supported in large part by non-food inflation. The Bank’s latest forecast shows that inflation will remain within the target band of 8±2 percent over the forecast horizon, barring any unanticipated shocks.

“The Committee noted that immediate risks to the disinflation path are well-contained, and the current conditions provide scope to translate some of the gains in the macro stability to the economy. Under the circumstances, the Committee decided to reduce the policy rate by 100 basis points to 16 percent,” the Governor added.

He further argued that the disinflation process has been supported by the relatively tight monetary policy stance maintained throughout the year, which has been able to contain underlying inflationary pressures as all the Bank’s measures of core inflation point to a general easing – and are further underpinned by well-anchored inflation expectations of both consumers and businesses.

The new policy rate is the lowest in nearly 6 years – that is, May 2013, when the policy rate stood at 16 percent. While lending rates remain close to the high-20s, the Governor is hopeful that lending rates will ultimately come down further – given loosening of the policy rate.

“The weighted average interbank lending rate – that is, the rate at which commercial banks lend to each other – however declined to 16.1 percent in December 2018 from 19.3 percent in the same period last year, reflecting the monetary policy stance. Similarly, average lending rates of banks also declined to 26.9 percent from 29.3 percent over the same comparative period,” Dr. Addison said.

thebft