Mobile phones serving as digital “wallets” for payments to response workers proved an invaluable tool in Sierra Leone’s response to the Ebola crisis, according to a new study.

The study was spearheaded by the Better Than Cash Alliance, a partnership of governments, companies, and international organizations that accelerates the transition from cash to digital payments in order to reduce poverty and drive inclusive growth.

Based at the UN, the Alliance has over 50 members, works closely with other global organizations, and is an implementing partner for the G20 Global Partnership for Financial Inclusion.

With economic instability, natural disasters and political conflict now taking place at unprecedented rates, the new research offers valuable lessons on how to harness the power of technology to help emergency workers reach more people by paying them digitally during crises. The country has been Ebola free since January.

The report comes just ahead of the first ever United Nations World Humanitarian summit set to begin next week.

The study shows digital payments delivered compelling results in Sierra Leone, including:

— Cost savings of US $10.7 million for the government, taxpayers, development partners and response workers – the equivalent of funding Sierra Leone’s Free Health Care Program catering for 1.4 million children and 250,000 pregnant women annually.

— Reducing payment times from over one month on average for cash to one week.

— Preventing the loss of around 800 working days per month from the Ebola response workforce, helping save lives during this critical time.

— Saving response workers around $80,000 per month in travel costs by avoiding lengthy journeys to cash payment centers.

Crucially, Sierra Leone’s experience shows the critical importance of governments, companies, and international organizations working together to develop policy frameworks, infrastructure and operating guidelines for digital payments before crises strike.

“Sierra Leone’s firsthand experience with digital payments and its impact on Ebola response and control taught us that, Governments like ours must take this growing payment system seriously as it can significantly contribute to inclusive growth and transparency,” said H.E. Momodu L. Kargbo, Sierra Leone’s Minister of Finance and Economic Development.“In developing the partnership with private sector, development organizations, the Central Bank, financial institutions, network providers; and building the foundation for an inclusive digital payment system, Government must take the lead.”

Sierra Leone was one of the hardest-hit countries during the Ebola outbreak, with more than 14,000 reported cases of the 28,000 total cases in West Africa. Ebola response workers were spread across Sierra Leone’s 14 districts, including many health units in rural areas. The speed with which Ebola spread meant the government needed a more efficient, reliable and secure tool than cash to manage payments to response workers in a country where there were fewer than 50 ATMs when the outbreak struck.

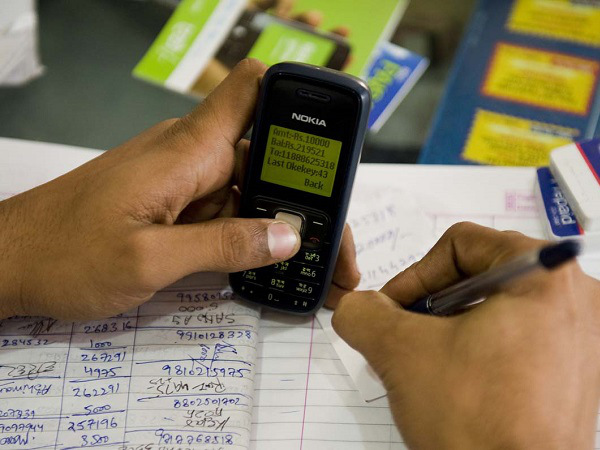

Digital payments offered a powerful solution, particularly given Sierra Leone already had mobile network coverage across nearly 95 percent of the country, and more than 90 percent of response workers with access to a mobile phone.

One of the major challenges of cash is that it is expensive, slow, difficult to transport and vulnerable to theft, graft and payment errors. Late or incorrect payments to response workers often led to strikes during past emergencies and at the start of the Ebola crisis before digital payments were implemented.

In Sierra Leone, digital payments reduced these strikes from an average of eight per month – causing the loss of about 800 working days per month – to virtually zero.

“Ebola response workers put their lives at risk every day. It was vitally important they received all the money they earned, with no skimming or theft.

They got it immediately, as their families had no other income; and only legitimate workers got paid – no one else. Paying Ebola response workers directly into a digital wallet instead of cash met these goals, saved lives and over $10 million,” said Dr. Ruth Goodwin-Groen, Managing Director of The Better Than Cash Alliance. “Sierra Leone’s experience shows the critical importance of developing and implementing national policy frameworks and supporting infrastructure to drive effective and flexible digital payments ecosystems in advance of humanitarian crises.”

The vast majority of the cost savings were due to eliminating payments to people who were not legitimate Ebola response workers, known as “ghost workers”. The money saved was given to those who really needed it.

The Better Than Cash Alliance is funded by the Bill & Melinda Gates Foundation, Citi Foundation, Ford Foundation, MasterCard, Omidyar Network, United States Agency for International Development, and Visa Inc. The United Nations Capital Development Fund serves as the secretariat.