BACKGROUND

In the 2016 budget presented by Ghana’s Finance Minister, Mr Seth Terkper, although satisfactory, some key issues raised by the minister have attracted missed feelings by researchers and watchers. One of the issues is the proposed establishment of the Export and Import Bank which the minister put as “Mr Speaker, we have always bemoaned our narrow export base and the resultant depreciation of the Cedi when we lose reserves from falling commodity prices. As part of our transformational agenda to achieve an export led economy, the Ghana Export and Import Bank (EXIM) Bill has been laid before Parliament.

The primary purpose is to finance export (notably high industrial and agricultural products); guarantee loans; provide export insurance, support SMEs and other businesses, and strengthen economic cooperation. The operations of the Bank will support the nurturing and growth of the private sector in Ghana to address the long standing problem of access to credit for expanded trade’’

There has been a deliberate attempt by Presidential TASKFORCE to insulate the Ghana Export –Import (EXIM) Bank from central bank guidelines (prudential norms). Prudential norms are guidelines and general norms issued by the regulating bank of a country for the proper accountable functioning of bank and bank-like establishment such as the Eximbank.

An Eximbank is a bank that provides financial assistance to export and import and for functioning as the principal financial institution for co-ordinationg the working of institutions engaged in financing export and import of goods and services with the view of promoting the countries international trade and matters connected therein. In dealing with Exim banks, buyers ought to be creditworthy and Eximbank must not compete with Private Sector Financing.

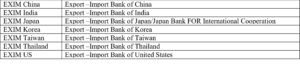

The term Exim means export and import. Examples of Eximbanks are:

Generally Eximbank engages in the following:

Export in the supply of goods and equipment on deferred payment terms, civil construction contracts, industrial turnkey projects and consultancy and service contracts. In the United States, Exim bank of US does the following:

Subsidize loans to foreign buyers of US products. Loan guarantees to support loans made by private sector banks to foreign purchaser of US products. Under loan guarantee, an exporter or foreigner buyer borrows from commercial bank. The risk of repayment of this loan is guaranteed by the eximbank. By this arrangement, eximbank support more exports than it could simply making direct loans. Loans and guarantees of working capital for US producers seeking to enter export market

Subsidize project finance

Sources of FUNDING

Mostly Exim banks are funded by governments in their respective countries. Others also raise funds from international capital markets. Below is example of capital structure of some Exim banks.

REGULATION OF EXIM BANKS

General speaking Exim banks are independent of central bank regulations, thus board appointed by governments in most cases supervises the Eximbanks.

In Ghana, it has been proposed by a taskforce headed by Mr Steve Williams that the bank be operationally independent but subject to policy direction by the Finance Minister and be exempted from prudential regulation of bank of Ghana, with supervision provided by the Minister. Additionally, the taskforce recommended that the bank should operate outside the remit of the Banking (Amendment) Act, (2007), Act 673, which currently regulates the operation of financial institutions in the country.

Ministry of Finance

Honestly speaking, putting Exim bank under the Minister of Finance will adulterate the aim of Exim bank. The Ministry of finance is a government agency masquerading as an independent institution and is highly susceptible to political pressure. What criteria go into the appointment of Finance Ministers in Ghana, anybody who pleases the President could be appointed to be a Finance Minister. If that is the case, then a corrupt person could be appointed as a Finance Minister with the sole aim to look looting Eximbank although the government is wasting GHS48.9 million to set it up.

The appointment of Finance Minister in Ghana does not require a person to possess special qualities like that of the Chief Justice or Speaker of Parliament. So unless that issue is worked at I don’t think Ghana Exim should be under the direct supervision of Finance Minister. Besides we have had instances where Finance Ministers in Ghana have gone to jail for causing financial losses, some have been fingered in one financial deal or other.

We have even had an instance where an American was appointed as Deputy Regional Minister, so because of these, we cannot trust either the appointment committee of any government in power nor the President to give the position to the right person.

Moreover, regulation of Exim bank should not be under the Finance Minister because it could lead to the place been another looting ground for foot soldiers and perceived members of the opposition parties may not be able to access assistance the bank. It will make exim bank another MASLOC or Poverty Alleviation Fund.

Lastly, Eximbank should not be under the Finance Minister because the government is worst manager when management of financial institutions. Compare bad debt at some affiliate and former affiliate state banks with that of Private banks and you will understand the issue better. Government through its finance ministry has no track record with the management of banks. The above analysis means Finance Minister should not be considered or entrusted with management of Eximbank that leads us to consider the second option of the central bank. A consummate banker and a former deputy governor of the bank of Ghana, Asiedu Mante was reported to have said central bank guidelines, collectively called prudential norms were only relevant in cases where the institution involved would be taking deposits and lending to the general public and once Eximbank will not do any of those, coming under the banking amendment act 2007, act 738 would be wrong.

Bank of Ghana

I beg to differ with the experienced banker. It may interest Mr Mante to know that some Exim bank normally accepts deposits. Indeed, in some jurisdiction deposits account for 2% of their funds. In India, section 12 (d) of Export and Import Bank of India Act 1981. No 28 of 1981 provides that Exim bank ‘accept deposits repayable after the expiry of a period which shall not be less than twelve months from the date of the making of the deposit on such terms as may generally or specially be approved by the Reserve Bank. If some Eximbank accepts deposits, they cannot escape the supervision of the bank of Ghana.

The question is, is the bank of Ghana ready to regulate the Eximbank? Looking at the recent challenges they are having with sanitizing the microfinance sub sector, I don’t think they can add that role. Besides, the bank of Ghana has proved beyond reasonable doubt that they cannot prevent ponzi scheme but can only exonerate itself from it after it has ravaged unsuspecting Ghanaians. This is true if Pyram, R5, Onward Investment Limited and DKM are anything to go by. That means they hands are tight.

On the other hand, putting exim bank under the full arm of Bank of Ghana could retard progress of the bank and will make Ghana’s Eximbank subject of ridicule as it will be at variance with all other Eximbanks. Honestly speaking the bank of Ghana could regulate some aspects of the Exim bank operations as in India and inputs could be made when the Act is sighted.

Policy Option

I think the management of the proposed Eximbank must be under a board appointed by Parliament but with two other members appointed by the President (such members must be seen to be competent by Parliament’ established standard or face rejection). Membership to the board must be based on merit, experience and track record. The board must report to Parliament. The board must act and take decisions in the supreme interest of the country and act in tandem with government policy. Special provisions must be made for young people who are new in business, young entrepreneurs, young graduates and women to erase the perception worldwide that Exim bank is anti MSMEs.

Contradictions of Ministry of Finance

The Minister of Finance in 2015 budget said ‘In 2015, EDAIF will establish presence in all the ten regions to ensure that it supports businesses in all parts of the countries’. In 2016, government taskforce is recommending EDAIF should be transferred to Ghana Export Promotion Authority as they put it ‘to help insulate the bank from additional responsibilities. The question is was it necessary to establish offices in all the ten regions and later fold up EDAIF? Or the Minister did not know he was going to set up Exim bank the following year? Ghanaians demand consistency in government policies and programmes.

FAD FOR EXIMBANK

The heightened interest in Eximbank could only be compared to that of oil discovery where hopes of Ghanaians were raised by Politicians but things have deteriorated with the discovery and commercialisation of oil. When did the government of Ghana start seeking the interest of Ghanaian exporters? I have been cynical about this suspicious act of President Mahama and that most researchers and market watchers are watching with keen interest the magnanimity of Monoliths NDC

The reality on the ground is vast majority of US exporters owe none of their success to eximbank finance. Indeed export giants like Monosanto, IBM, Dupont, Dow or Phillips Moris do not receive exim financing. Secondly, intel, sun Microsystems, xeron, Hewlett Packard, Unisys and Compaq receive little or no export financing.

Thirdly, medical equipment and semiconductor exports grew on average of 14% and 32% annually respectively without eximbanks involvement. And exim cannot claim credit for the 11% annual growth rate of US auto export.

In 1992, export of non subsidized financial services totalled $5.4billion in 1992 compared with subsidized export of wheat of $4.6billion.

From above it is clear that Eximbank alone is not the panacea to our low export base as Mr TERKPER would want us to believe. In order to increase our export base, more money must be spent on export promotion. The US, with approximately more than $700 billion in annual export, still spends more than $3 billion annually on export promotion activities. How much does the government of Ghana allocate to Ghana export promotion Authority to promote export? That figure tells you that we are not serious as a nation that wants to promote export.

Access to markets must also be worked on else we will have Eximbank but will not see any improvement in our export base. Also the cost of doing business must also come down else we may have Eximbank but our products will still be uncompetitive. We are in an era where expenditure on electricity alone has increased by 450% over the past 12 months. How can one compete globally with these figures? Countries that have Eximbank have solved all problems with their export sector hence their decision to establish Eximbank but Ghana still has several problems with our export sector yet we want Eximbank

THE WAY FORWARD

Looking at the situation, government must focus attention in building stronger institutions before starting with the eximbank. Weaker institutional framework caused havoc at GYEEDA, and other places so existing institutions must be strengthened before thinking about Eximbank. Going forward I think we can develop factoring and forfeiters systems in Ghana before tacking Eximbank establishment. As to whether what I am saying is right or wrong, time will tell.

BY YAW OHEMENG KYEI

Finance and Management Consultant @ Likert Business Solution

(Former Finance lecturer of Presbyterian University College, Tema Campus)

Contact him at yawohemengk@yahoo.com