China’s industrial output has slowed to its weakest growth since the financial crisis, prompting concerns over the global recovery.

Production rose by 5.4% in January and February – the worst since 2008.

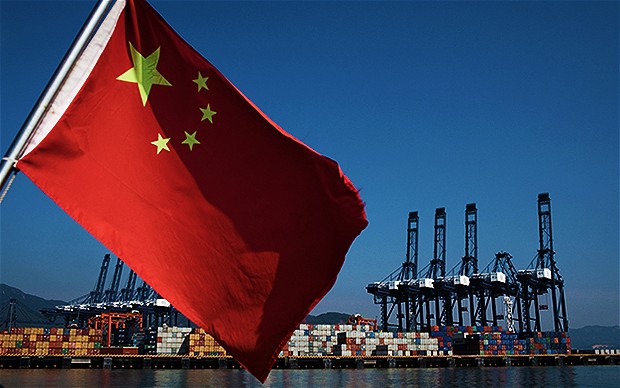

China is trying to refocus its economy from investment and export-led growth to consumer spending.

UK finance minister George Osborne said China’s slowdown is one of a “dangerous cocktail of risks” hampering recovery from the 2008 financial crisis.

Recent data revealed that Chinese exports fell 25.4% in February compared with the same month last year.

It was the biggest monthly decline since 2009, and ahead of the 11.2% fall recorded in January.

Retail sales in the first two months of the year grew by 10.2% – below analysts’ expectations of a 10.9% rise.

Zhou Hao, an economist at Commerzbank, told Bloomberg that the mix of slower industrial output and retail spending “gives us a worrying picture”. He said: “The overall growth profile remains still gloomy.”

However, Zhou Xiaochuan, governor of the People’s Bank of China, said that the government would be able to achieve a target of an average 6.5% in GDP growth for the next five years without implementing measures to stimulate the economy.

“Excessive monetary policy stimulus isn’t necessary to achieve the target,” he said. “If there isn’t any big economic or financial turmoil, we’ll keep prudent monetary policy.”

Writing in the UK’s Sun on Sunday ahead of presenting a budget on Wednesday, Mr Osborne said falling oil prices, interest rate changes elsewhere and political instability in the Middle East meant “hopes of a strong global recovery have evaporated”.

Source: BBC