Access to finance and the high cost of credit continue to impact negatively on the operations of Small and Medium Enterprises (SME’s) in the country.

The situation has been attributed to the absence of adequately resourced institutions as well as some macro-economic policies that discourage granting of credit due to the high risks associated with some SMEs.

The Association of Ghana Industries (AGI) for instance, at a stakeholders’ forum, revealed that almost all proposals by its members to secure funding from the Export, Trade Agricultural and Industrial Development Fund (EDAIF), were denied in 2015.

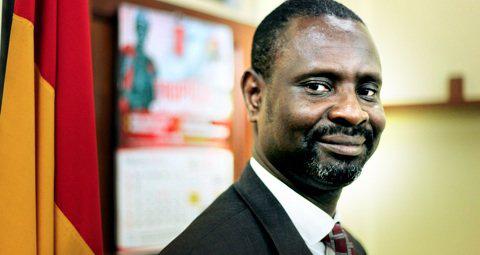

President of AGI, James Asare Adjei also tells Citi Business News addressing such needs will enhance private sector growth and development.

“What we need to do as a country is to look at the financing dynamics that we have to give such that The SME s will develop. AGI has established a fund that seeks to provide support to its members but we are limited to what we can do; so we call on government for its support to be able to go outside of the capital to be able to go and support such businesses to be able to grow and create the needed employment,” Mr. Asare Adjei said.

Venture Capital challenged

In a related development, the Chief Executive of the Venture Capital Trust fund, Osman Sulemana, has cited the fund’s limited revenue sources as a major factor accounting for its inability to provide support to Small and Medium Enterprises.

According to him, the fund’s overreliance on budgetary support from government makes it difficult to meet most of the funding needs of SMEs.

Being in existence for about a decade now, the Venture Capital trust fund is mandated to provide equity and quasi-equity investments as well as managerial and technical support to SMEs.

But Osman Sulemana maintains the absence of a statutory source of revenue following the repeal of the national reconstruction levy; has continuously impacted the Fund’s operations.

He however explains to Citi Business News new strategies which should enable the fund access revenue from the international market.

“We set up a committee somewhere last year to sit and review the law so that we will be given the opportunity to be able to input a tax to be paid to us directly. But the Ministry of Finance wrote to us demanding an impact assessment on the activities of the Fund. We have since finalized the report and yet to submit the report to the Ministry for the committee to start sitting, when that becomes possible and the maybe we will be given the opportunity to borrow from the international market to aid our operations,” Osman Sulemana stated.

By: Pius Amihere Eduku