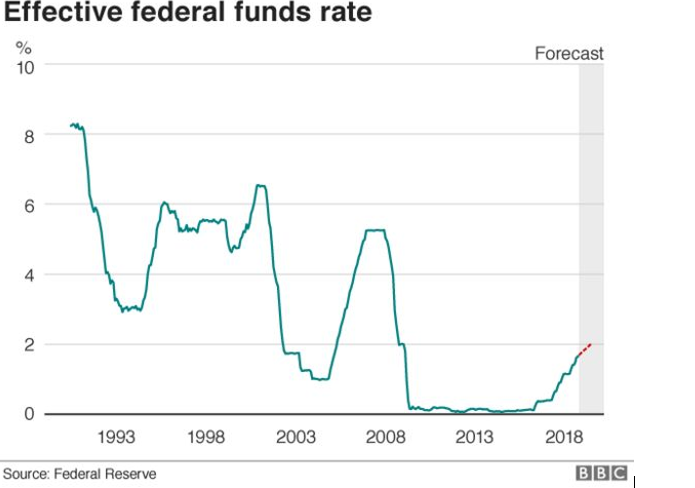

US central bankers are expected to raise a key interest rate again this week in response to healthy growth and low unemployment.

Policy makers at the US Federal Reserve are expected to raise the target for the Federal Reserve’s benchmark rate by 0.25%, taking it to the highest since 2008, at 1.75% to 2%.

Fed officials are due to announce their decision later.

A rise would mark the Fed’s seventh rate increase since 2015.

Officials aim to head off excessive inflation with higher rates and think the US economy can handle higher borrowing costs.

They are also shrinking the Fed’s massive holdings of government debt and mortgage-backed securities, which were purchased to lift the economy out of the recession that ran from late 2007 to 2009.

As higher rates start to take hold, the repercussions are being felt in the US and overseas.

Global pain

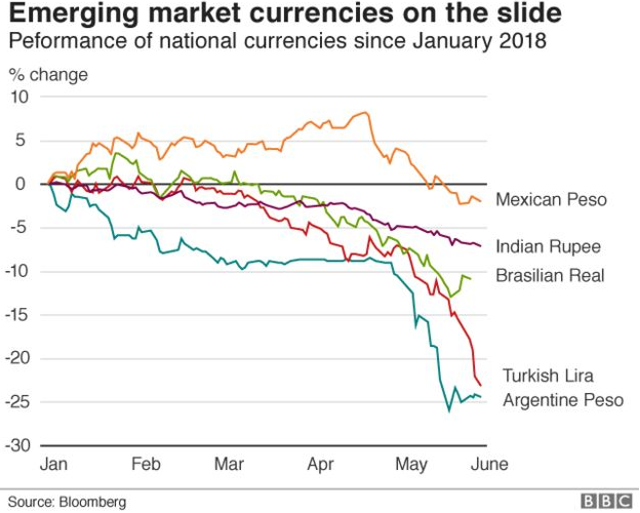

Some of the most dramatic effects have appeared in emerging markets, as higher US rates lure back investors who had turned overseas in recent years in search of returns.

The retreat from emerging markets remains relatively modest, with weekly flows to bond and equity funds down less than 10% from their peaks, according to EPFR Global, part of research firm Informa.

But it has coincided with – and partially fuelled – a stronger dollar, contributing to currency crises in countries such as Argentina, Turkey and Brazil.

It has also prompted central banks elsewhere, including in Indonesia, Malaysia and Hong Kong, to raise their own interest rates in defence.

Countries that have seen the worst market turmoil have also faced political and financial problems of their own.

But the Fed may be underestimating its role, said Desmond Lachman, a fellow at the American Enterprise Institute and former head of emerging market strategy Salomon Smith Barney.

He pointed to recent remarks by Federal Reserve Chair Jay Powell that the power of US interest rates is “often exaggerated”.

If the turbulence persists, it could hurt economies abroad, eventually reducing demand for US products and services, he added.

“Fed tightening is causing all sorts of problems for many emerging market countries and those problems can then come back to impact the United States,” he said. The Fed “should be focused on it, but I don’t know how much it is”.

Consumer caution

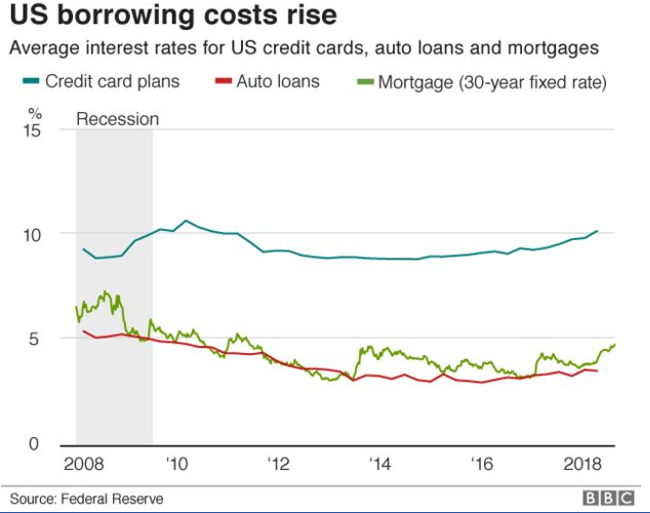

In the US, banks are passing on higher borrowing costs to customers, raising the rates they charge for items such as credit cards, mortgages and car loans.

Consumer spending – a major driver of the US economy – has held up, as a strong economy gives people confidence they can shoulder the added cost.

But with US incomes still relatively flat, higher rates could eventually induce greater caution.

Signs of strain are already visible in parts of the economy dependent on borrowing, like the housing market, where the pace of home sales has weakened, amid low supply and high prices.

A strong job market has helped to limit the effects, but economists say rate rises could cause buyers to retreat, even though average mortgage rates – which topped 4.5% this spring – remain several points lower than before the financial crisis.

Fed officials are well aware wage growth has been sluggish, of course. They often cite it as a reason to be cautious about raising rates.

But they want to prevent dramatic price inflation, which many economists expect to accelerate after the US passed a massive tax cut last year.

Bank windfall

Higher interest rates should be a boon to savers, who stand to earn more on the money they have squirreled away in bank accounts.

But US banks by and large have been slow to boost the interest paid on savings and other accounts.

Banks offered an average interest rate of 0.15% for a typical savings account in March 2018, up just 0.03 percentage points from three years prior, according to data from the National Credit Union Administration.

So far, the paltry rates have helped to lift bank profits, without costing them accounts.

But analysts say customers will look for better terms if they see inflation start to eat away at their stockpiles.

Data suggests that inflation, which has lagged the Fed’s target 2% rate in recent years, may be starting to pick up, so banks may have to start moving if they want to keep deposits.