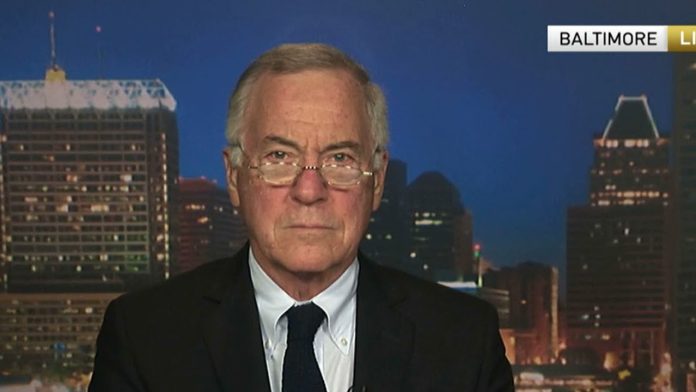

Professor of Applied Economics at the Johns Hopkins University, Steve Hanke has suggested to the Government of Ghana to create a currency board as part of moves to stabilize the Cedi against the major trading currencies especially the dollar.

He placed Ghana’s currency 15th among a list of nineteen performing currencies.

In a tweet, Prof Hanke said “By my calculations, the Ghanaian Cedi has depreciated 34.17% against the USD since Jan. 2020, which is why Ghana is in 15th place in this week’s Hanke’s #Currency Watchlist.

“To save the cedi,” he said, “Ghana must mothball its central bank and install a #CurrencyBoard.”

He added Ghana takes the 10th place in this week’s inflation table. On August 4, I measured Ghana’s inflation at a stunning 58%/yr-almost 2x the official inflation rate of 30%/yr. Ghana must mothball its central bank and install a Currency Board.”

The Cedis is trading at ¢9.20 to a dollar, as of Monday August 8.

Earlier this year, the Governor of the Bank of Ghana Dr Ernest Addison said the would soon start appreciating given the interventions from government and the central bank.

He indicated that the central bank had put in place measures to increase forex supply on the market as part of short-term measures to shore up the local currency.

“As you are aware, the cedi came under pressure in the early part of February. And the reasons include the fact that we have lost access to the capital market and therefore we were not going to issue a bond this year which has negative implications for the availability of foreign exchange. The government has announced its intentions to raise UD$2 billion from some syndicated arrangements with banks.

“If that goes through, that should help improve the supply of foreign exchange to the economy as a whole and should impact positively on the cedi,” he said.

He added “In terms of what the Bank of Ghana has been doing, we have the fortnightly foreign exchange auctions where we make foreign exchange available to the system and in the last few weeks, we have been making special allocations to the [Oil Marketing Companies] OMCs and the energy companies as well as the cement producing companies.

“I can tell you that, as of last week, we have completely cleared the pipeline demand for foreign exchange from these OMCs,” he said at an engagement with the media in Accra.

“We have made foreign exchange available to the market broadly and we think all of that should help in terms of mitigating the depreciation of the cedi. These are all short-term immediate measures that we are taking to address the matter.

“We have also announced an increase in our policy rate and that action in itself should make our domestic market more attractive and improve the incentive in cedi denominated assets.

“We also want to look at the retention agreements with the oil drilling companies etc. These are medium to longer term measures to improve the foreign exchange earning capacity of the economy as whole. So we are quite confident that these measures will stabilise the cedi,” Dr Addison added.

By 3news