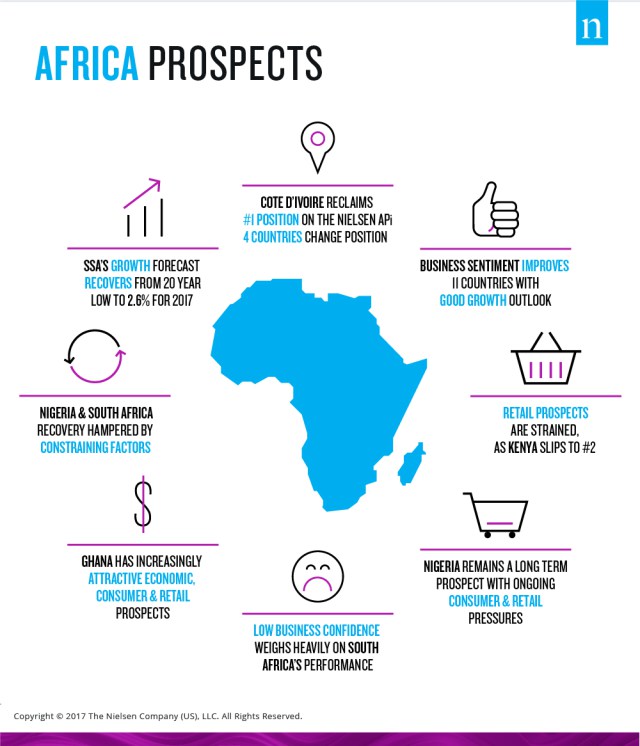

Sub-Saharan Africa has uplifted itself from the two decade economic low reached in 2016, bringing a slight easing of pressure, but not a return to the robust growth rates previously experienced. The region’s two most significant economies, Nigeria and South Africa, are slowly turning around from recent declines to low levels of positive growth, however, the consolidated prospects for these two powerhouse economies continue to be subdued. Of the countries measured in global market research company Nielsen’s 5th Africa Prospects report, South Africa slips two positions to sixth place and Nigeria remains in eighth place.

Cote d’Ivoire once again leads the Africa Prospects ranking with strong macro-economic and retail prospects, but the country is dealing with deteriorating political stability and declining cocoa prices, which could lead to an economic deficit and pressure on household income, amplifying the already weaker consumer prospects.

Kenya relinquishes top position due to fading macro-economic indicators and a declining business outlook amidst an unsettling election period, drought, and credit slowdown. It is worthwhile to note that Cameroon’s rise to fourth position is its highest rank to date. With a diversified natural resource base, rapid urbanisation and GDP per capita on par with Kenya, and higher than Uganda and Ethiopia, it is easy to understand its stronger consumer and retail prospects. These are, however, offset by weaker macro-economic and business prospects.

Tanzania and Uganda remain unchanged in the latest ranking. Tanzania continues to rank favourably in third position with steady economic growth and business-friendly reforms singling it out as a worthy prospect. Uganda, in seventh position, remains subdued after a tumultuous 2016 marred by election-related uncertainty, a debilitating drought and high commercial lending rates.

Ghana maintains fifth position on the APi, but this masks some of the ongoing improvement in the macro-economic, consumer and retail rankings. It has also been rated as the best business prospect for successive periods. Food inflation continues to decelerate easing the pressure on consumer wallets, resulting in an increasing number of Ghanaians spending more in store, more willing to try new things and positively influencing the previously weaker retail outlook.

The Africa Prospects Indicators integrate business, consumer and retail prospects together with more speculative macro-economic factors to bring companies closer to the consumer market realities, helping with identifying investment opportunities that will achieve maximum impact, based on the overall and relative potential. – AB