The option of a one-time payment holiday during times of intense crisis might enable countries to pandemic-proof their bonds, a prominent debt fund believes.

Economic fallout from COVID-19 has triggered a record number of sovereign defaults in 2020, and managers at Boston-based GMO, heavily involved in sovereign restructurings in recent years, have proposed redesigning bonds so that countries can suspend or even wipe off debt payments for up to a year.

Credit rating agency S&P has downgraded 51 countries this year, and four – Lebanon, Ecuador, Argentina and Belize – have already defaulted, beating a record set in 2017.

“In the case of Ecuador, it might have provided enough liquidity relief to prevent a default,” said GMO’s Carl Ross, one of the payment holiday plan’s two architects and a negotiator in Ecuador’s and Argentina’s restructurings.

He favours that idea over current approaches such the linking of debt payments to economic fortunes chosen in 2012 by Greece, and the “hurricane clause” – offering debt relief if a second catastrophic storm hits – used in Grenada’s 2015 restructuring.

“Our proposal is to revert to something much simpler,” Ross said. “The whole idea is to prevent countries getting into distress in the first place”.

Sui-Jim Ho, a partner at Cleary Gottlieb – the law firm that helped draft Granada’s hurricane clause – said discussion around temporary debt suspensions was gaining traction.

However, he questioned how simple implementing them would be.

“We still need to figure out how the pandemic trigger event should be drafted,” he said “…Defined too loosely and it could be triggered too easily. Defined too restrictively and you could end up with too little too late.”

Graphic: Bond prices plunge ahead of defaults here

GAME THEORY

Ross said the potential criticism that GMO’s proposal could be abused by politicians looking for creative funding options was a low risk.

Bond markets would soon work out governments that tried to play the system, and as the deferral option would only be available once – or perhaps once a decade for long-term bonds – it was also likely to be used sparingly.

“Interactions between bond markets and governments are a ‘repeated game’ … We believe this dynamic would be a very effective self-policing mechanism,” he said.

His idea would need International Monetary Fund or U.S. Treasury support to take off, and a country would also have prove it was workable.

Ross said he suggested it to Ecuador but the process was moving too fast by then, and it wouldn’t have prevented Argentina or Lebanon defaulting as their debts had already spiralled out of control.

Countries hit by multiple crises wouldn’t be saved either as having more than one deferral or debt forgiveness option would ramp up their borrowing costs.

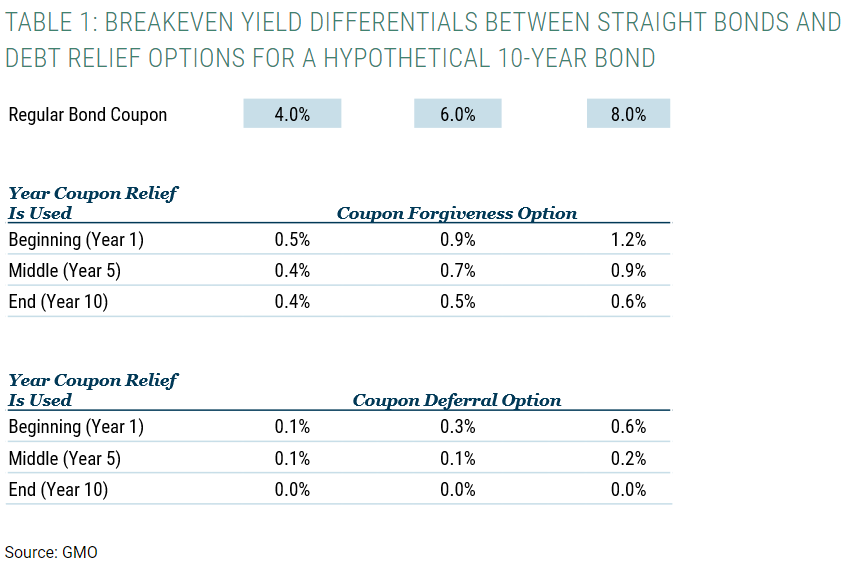

Ross and the proposal’s co-author, Mustafa Ulukan, estimate that a single one-year deferral option might only add 0.6% to the 8% a country with a low B-grade rating might pay to borrow for 10 years.

The approach could also address ‘freeriding’ criticism private sector bondholders are now facing for not following G20 governments and allowing the world’s poorest countries to suspend debt payments during COVID-19.

Pressure for that to happen is growing but creditors warn the rating agencies would class it as a default, opening up a host of problems. That is something GMO thinks its plan would avoid.

“This (deferral) option, if broadly used, would be extraordinarily valuable in the current global environment,” Ross said. “This year and 2021, we have a lot of countries that are going to default.”

Graphic: How much extra could the debt deferral option cost here

Reuters