By Frederick ASIAMAH

EEAR Private Equity (EEAR P.E.), an emerging private equity firm, has announced that it has secured rights to manage a US $500 billion fund for government developmental and infrastructural projects in Ghana and across the West African sub-region.

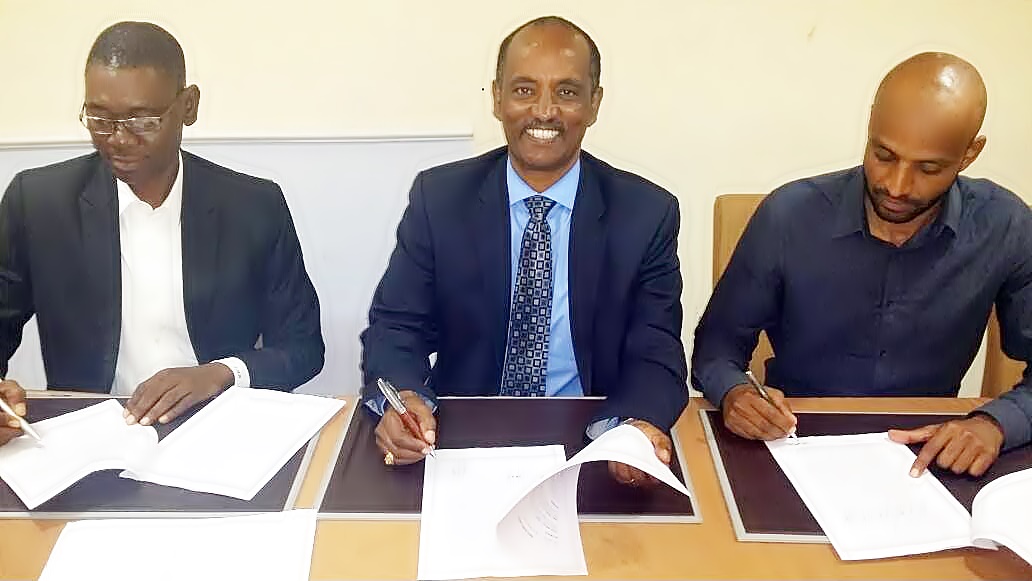

The privately owned Ghanaian firm has completed and signed all the needed agreements to represent African Communications Resources ltd (ACR) and Genco Agro (GA), fund owners and administrators in West Africa.

Mr. Richard Dugan, Group President of EEAR Holdings, said: “We look forward to working with governments across the region, particularly in Ghana, to facilitate plans on development. This fund will in no doubt support infrastructural and developmental projects in West Africa and we are excited to be engineering this change.”

Infrastructural need

At the continental level, experts say infrastructure has played a significant role in Africa’s recent economic turnaround, and will need to play an even greater role if the continent’s development targets are to be reached.

According to the World Bank, simulations suggest that if all African countries were to catch up with Mauritius in infrastructure, per capita economic growth in the region could increase by 2.2 percentage points.

The global financial institution has calculated that “The cost of redressing Africa’s infrastructure deficit is estimated at US$38 billion of investment per year, and a further US$37 billion per year in operations and maintenance; an overall price tag of US$75 billion.”

The global bank adds that the total required spending translates into some 12 per cent of Africa’s GDP. There is currently a funding gap of US$35 billion per year.

In a March 2015 paper, PwC Nigeria reviewed the potential of infrastructure in West Africa and reported that only about 30% of the sub-region’s population have access to electricity compared to 80% in other parts of the developing world; transport costs are about 100% higher; road access rates are about 34% compared to over 50%; internet penetration rates of roughly 6% compared to 40%.

At the country level, it is estimated that Ghana requires at least $1.5 million annually to finance its infrastructure deficit.

Execution

Meanwhile, EEAR P.E. has indicated in a statement copied to Business Day that it has appointed McOttley Capital as executioners to assist with this project. McOttley Capital is Ghana’s fastest growing new investment bank which provides services in investment Banking, Asset Management, Professional Retirement and Pension Fund management.

“With this agreement, EEAR Private Equity will originate, structure and execute sovereign funding and governmental projects that meet funding criteria on behalf of Africa Communication Resources (ACR),” said Mr. Iddrisu Mahama, managing partner of EEAR P.E.

ACR is an international privately owned organisation based in Mauritius, with no relation to any government, non-government agency, or financial institution, whose core mandate is to develop various projects under private and public partnership. It provides infrastructure development projects in power generation, housing and real estate, agriculture, oil and gas, and the mining industry.

On the other hand, EEAR P.E. is a limited liability company in Ghana set up to raise funds and capital for startups and existing businesses with viable intents for profitability. It is a subsidiary of the EEAR Holdings, the mother company for an impressive number of subsidiaries operating in non-banking financial services, healthcare, insurance brokerage beverages and multimedia.