Financial reporting is a crucial function for any organization and usually presented through financial statements.

Thus, financial reporting provides key stakeholders with valuable insights into a company’s performance. Indeed, it enables them to plan based on their understanding of the facts behind the figures.

However, many non-professionals find it difficult to interpret and understand financial reports. To overcome the challenges, arises the need for organizations to explore data visualization tools to make financial reporting or communication easier to understand.

Data Visualization

Data visualization is the graphical representation of data in the form of charts, infographics or statistical graphs. In the context of financial reporting or communication, data visualization tools can convert a financial statement into easy-to-understand visuals (charts, graphs, and diagrams). As a result, it is easier for finance teams in an era of technological innovations to collect big data, analyze, and present it in a visually appealing way to aid understanding of a business’ financial performance.

Data Visualization Tools

Data visualization tools are software applications that can revolutionize the way organizations report financial data by creating interactive charts, graphs and trends and patterns. Financial data visualization tools support efficient data analytics to present graphics instead of text-only reports. Data visualization applications are user-friendly and allow users to input a dataset and graphically alter it.

Many data visualization software applications provide drag-and-drop functionalities that enable users to create a dashboard to monitor an organization’s critical data. However, some do offer the ability to create dashboards using codes. A modern data visualization tool can handle big data from many sources including file uploads and databases. Indeed, connecting some applications or databases may require some level of Information Technology (IT) involvement or coding knowledge and skills.

Harnessing the Power of Data Visualization Software

A picture is worth thousand words. This statement reinforces the fact that people process images and understand them in a context much better than they do with texts-only reports. Data visualization software can transform financial reporting by enabling finance teams to communicate complex financial data with more engaging and easy-to-understand visuals. Some other benefits of using data visualization tools or software are:

- Discovering Emerging Patterns & Anomalies

Auditors can perform faster prediction tasks using graphical information than using tabular information. Data visualization reports help to detect patterns people might otherwise not notice. The reports give auditors and other relevant stakeholders the necessary information to minimize the risk of fraudulent transactions and prevent them from occurring. Data visualization tools can help organizations to create dashboards for fraud detection and risk management.

- Fast-Tracking Trend Analysis

There is no need to sort and filter countless rows and columns of data through the traditional and laborious methods when you can generate graphical representations of any dataset with data visualization software. Thus, with visualization applications, you can create bar charts, line charts, pie charts or even heat maps instantly to enable you to identify the macro and micro details of the same situation. For example, an organization that deploys data visualization tools can look at a graph of monthly transactions to identify trends of monthly reports of performance to inform its decisions and strategies.

- Providing Holistic Data Insights

The ability to support your claims with facts boosts your credibility during reporting as well as presentation to stakeholders. Thus, the use of visuals to present a financial information in a unified format gets everyone on the same page especially when combined with a single source of truth (SSOT). Data visualization makes it easier to work with huge datasets and grants the freedom to scale datasets. Besides, data visualization tools simplify data sharing and collaboration between departments. Hence, teams can collect data, process it, analyze and present same in real-time. In essence, collaboration with the help of innovations eliminates data silos thereby providing a unified understanding of data.

- Facilitating Easier Interpretation of Data

Data visualization is an easy way to understand and learn from data. It is worth reiterating that since many of us are visual learners, using data visualization helps convey a message or an insight easily compared to long blocks of text or spreadsheets. The deficiency in the traditional methods is that they can only provide static data based on historical information. By the time the latest data is collected, cleaned and processed, it becomes outdated and may not be as effective when used in decision-making.

- Time-saving

An organization’s stakeholders are increasingly inundated with volumes of information in financial reports. They are thereby looking for easy-to-understand presentations that is efficient and effective with time use on those reports. In this regard, an interactive data visualization tool removes the burden of time that a non-professional stakeholder uses to process and clearly understand a financial statement. The availability of search features, concise presentations and multiple relevant visualizations can help individuals to navigate financial reports more easily, hence spend their time more judiciously.

- Improving Decision-making

The visualization process allows finance teams to navigate, to select data and display it at various levels with details and in many formats. This way, they are able to tell compelling stories with financial data, thereby providing assurances and improving communication that builds trust with stakeholders. Furthermore, allowing decision makers to interactively process information and select multiple presentations or visualizations relevant to their tasks can improve their decision-making outcomes. Data visualization also allows financial decision-makers to gain clarity on their reporting and deeper confidence in their forecasts especially for financial planning and analysis during a market correction of declining investments or stocks.

Driving Quality Outcomes

To optimize the application of data visualization tools requires that users must be aware of the following:

Identifying Relevant Data Sources

To prepare a financial statement devoid of inaccuracies means that finance teams need to start with the right data sources. Relevant data not only ensures credibility of reports but also serves as the basis for efficient application of visualization tools.

Evaluating Visualization Tools

There are many different data visualization tools available on the market but it can be very challenging to choose the right ones to suit an organization’s reporting framework. There are cloud-based automated accounting suites and other user-friendly data visualization tools that can help finance teams to instantly create detailed visual financial reports.

Stakeholder Interest

In the application of visualization tools to present reports, it is worthwhile to consider stakeholders’ varied interests and expectations. It is true that internal stakeholders’ (senior management and other employees) interest sometimes conflict with external stakeholders (regulatory agencies, tax authorities, investors, lenders) expectations. As a result, in the application of visualization tools, you must always know those conflicting interests of these interest groups so that you can clearly align your strategies and presentation to them. This is clearly the basic essence of financial reporting or communication. By extension, the choice and integration of data visualization tools into an organization’s operations is influenced by stakeholder needs expectations.

Conclusion

Data visualization tools allow finance teams to present complex financial information by amplifying data impact with compelling visual stories. By identifying valuable insights faster and communicating financial reports in a clear and compelling way, stakeholders are more than empowered to improve financial planning, analysis and reporting which invariably leads to better and informed decisions to drive business growth.

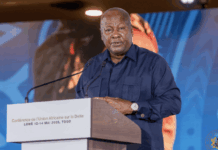

BERNARD BEMPONG

Bernard is a Chartered Accountant with over 14 years of professional and industry experience in Financial Services Sector and Management Consultancy. He is the Managing Partner of J.S Morlu (Ghana) an international consulting firm providing Accounting, Tax, Auditing, IT Solutions and Business Advisory Services to both private businesses and government.

Our Office is located at Lagos Avenue, East Legon, Accra.

Contact: +233 302 528 977

+233 244 566 09

Website: www.jsmorlu.com.gh

THEBFTONLINE.COM