Despite the recent change in Cash Reserve Ratio (CRR) policy during November 2023, liquidity in the market remains high – prompting the Bank of Ghana (BoG) to signal further efforts aimed at mopping up excess liquidity.

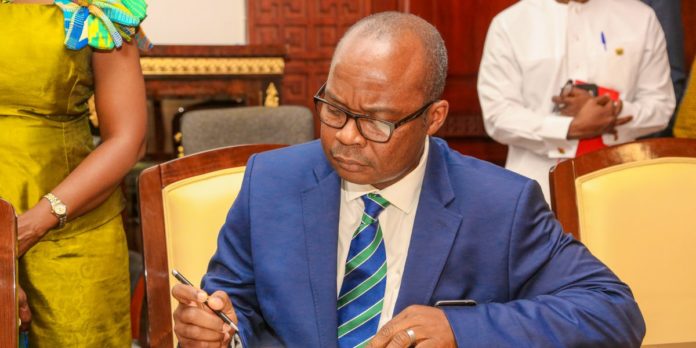

Dr. Ernest Addison, Bank of Ghana Governor, acknowledged the prevailing liquidity situation in a press conference following the 116th MPC meeting; emphasising the challenges faced by banks in finding suitable investment avenues.

“It appears there’s still quite an amount of liquidity in the market. This is one of the issues we extensively discussed last week. The auctions are oversubscribed and the banks have mobilised a lot of deposits, making them very liquid.

However, there aren’t many avenues for investing their resources so they are putting it back into the auction. The economic conditions haven’t improved enough to reduce the risk associated with lending, prompting them to invest in short-term government bills instead,” Dr. Addison stated.

The central bank’s decision to unify and raise the CRR to 15 percent, on both local and foreign currency accounts, aimed to address the banking sector’s surplus liquidity and support the ongoing fight against inflation. However, concerns have been raised about potential increases in government borrowing costs in the domestic Treasury market as a consequence of this reserve hike.

In response to questions on impacts from the CRR change, Dr. Addison said: “The CRR policy change likely had an impact, but there’s still a significant amount of liquidity”.

The new CRR directive, effective since November 30, 2023, was expected to drain about GH¢11billion in cedi liquidity from the interbank market while releasing approximately US$750million. This move aimed to enhance liquidity conditions in the FX market, potentially curbing the pace of depreciation during the festive season.

Base money growth slowed down significantly in 2023, reaching 29.2 percent by December compared to 57.5 percent in December 2022. The deceleration was attributed to strong BoG sterilisation efforts and effective liquidity management operations.

Similarly, interest rates in the money market experienced a downward trend – with the 91-day and 182-day Treasury bill rates decreasing to 29.49 percent and 31.70 percent respectively in December 2023. The 364-day instrument’s rate also decreased, to 32.97 percent during the same period.

During its November 2023 Monetary Policy Committee (MPC) meeting, the central bank highlighted the slowdown in monetary aggregates’ growth, indicating a contraction of 2.6 percent in reserve money on a year-on-year basis during October 2023. Unifying the CRR for both cedi and foreign currency deposits was a strategic move to manage excess structural liquidity conditions and support the disinflation process.

Banking sector performance

The banking sector’s performance showed signs of improvement, with stability, liquidity and profitability highlighted in the end-of-year data. The sector rebounded from the loss recorded in 2022’s audited accounts, showcasing increased net interest income and fees & commissions.

Despite challenges posed by the Domestic Debt Restructuring and macroeconomic difficulties in 2022, the banking sector demonstrated resilience. The capital adequacy levels remained above minimum regulatory requirement, and most banks held excess liquidity. However, the industry’s Non-Performing Loan (NPL) ratio increased to 18.3 percent in October 2023 – reflecting elevated credit risk associated with lingering effects of the 2022 macroeconomic crisis.

The private sector credit expansion remained sluggish, growing at 10.7 percent in December 2023 compared to 31.8 percent in December 2022 and reflecting increased risk aversion among banks.

Story By B&FT