…As Ghana Cedi depreciates 1%

By Ernest KISSIEDU

The Bank of Ghana (BoG) has emphasized the need to put a high premium on stability of prices and foreign exchange rates as well as recapitalize the various banks in the country.

This will help preserve confidence in the banking sector.

When reviewing the economy at its latest meeting last week, the Monetary Policy Committee (MPC) of the BoG reduced its key lending rate to commercial banks by 100 basis points to 22.5 percent, down from the previous rate of 23.5 percent.

This is the second reduction for this year after the biggest rate cut in a long while in March.

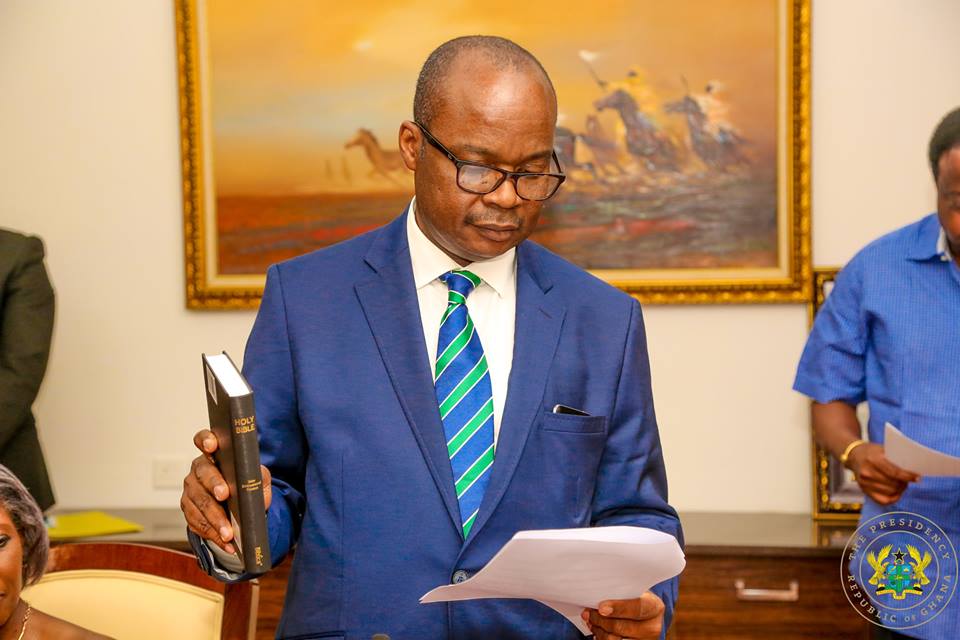

Briefing a section of the media in Accra on the outcome of the MPC’s deliberations, Dr. Ernest Addison, BoG Governor, highlighted stable inflation as the reason for reducing the policy rate.

“There are indications that growth is likely to remain significantly stable, alongside an improved inflation outlook, which provides some scope for monetary policy easing,” he said.

According to Dr. Addison, headline inflation and inflation expectations have broadly trended downwards.

“The disinflation process has been supported by tight policy stance and exchange rate stability,” he added.

For the BoG Governor, the down size risk is lower compared to high size risks in relation to the stability of the cedi.

“With the stable outlook for exchange rate movements and the return to the path of fiscal consolidation, headline inflation is expected to trend towards the medium-term target in 2018, barring any unanticipated shocks,” Dr. Addison pointed out.

The Governor indicated that the volatility in the foreign exchange market observed at the last MPC meeting has eased significantly, supported by improved foreign exchange liquidity conditions and the outturn in the trade balance, with a more positive outlook based on significant expected inflows.

“Cumulatively, the Ghana Cedi has depreciated by 1.0 percent against the US dollar in the year to 18th May 2017, compared with 3.5 percent reported at the last MPC round.”

“Gross International Reserves increased to US$6.4 billion, an equivalent of 3.7 months of import cover, at the end of April 2017 from US$4.9 billion (2.8 months of import cover) at end-2016,” he cited.

Growth

The recently released GDP data from the Ghana Statistical Service showed that growth outcome for 2016 was slightly weaker than expected, mainly due to a significant decline in industrial growth following the adverse effects of the energy crises and operational challenges in crude oil production for the most part of the year.

The overall GDP growth for 2016 turned in at 3.5 percent against an envisaged growth of 4.1 percent.

The banking system recorded strong asset growth in the year to April 2017. Total asset base increased by 30.9 percent to GH¢84.5 billion compared to an asset base of GH¢64.6 billion as at April 2016. The growth in assets was funded mainly by domestic deposits, which increased by 28.4 percent (GH¢11.7 billion) in April 2017.