The Controller and Accountant-General’s Department says it is working towards restraining public officials from buying treasury bills with state funds for personal gain.

As a first step, accounts of Ministries, Departments and Agencies (MDAs) with commercial banks have been closed.

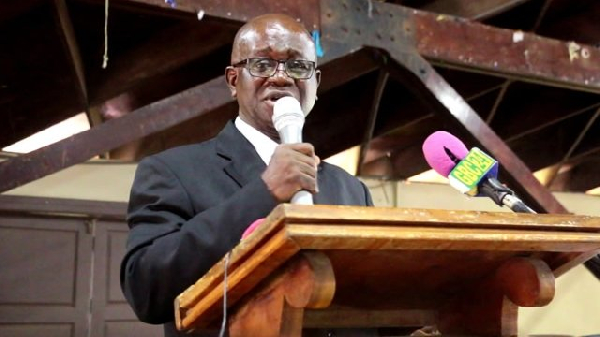

“Government through the budgetary process allot funds to the various MDAs, and other State Agencies. Many who get the money are not ready to disburse the money, such [funds] when released, they put in their accounts and they turn round to use the same money to invest in treasury bills and who buys the treasury bills? The same government goes at the auction to buy the treasury bills,“ Controller and Accountant-General, Eugene Asante Ofosuhene said.

Mr Asante Ofosuhene, says all such funds will be moved to the Bank of Ghana as part of the implementation of the Treasury Single Account (TSA).

The move by the Accountant General’s Department is meant to prevent institutions from hi-jacking funds meant for projects for their own profits before releasing them for the intended purpose.

In financial management, availability of funds is very important but the government is often challenged with funds, forcing it to, sometimes, borrow to support the budget.

“Once the monies are all in the central bank, Government can always be in the position if it wants to borrow such monies, they can take the money from those accounts, use it and put it back and here government doesn’t pay any interest.

“If for any reason we need money to close a gap or emergency we can always fall on the bank and use the money and once the revenues flow in, we put it back. That is the essence of the single treasury accounts. That is what is helping the government to manage its finances. It is not only Ghana, Nigeria has been using it. We want to go step by step, so we started with MDAs and later on we escalate to other state agencies,” he said.

At a Durbar in Kumasi, Mr Asante Ofosuhene said the second phase of the exercise will soon begin.

He says compelling state institutions to bank with the central bank is the way to go to enable the government to obtain a consolidated view of its cash resources at the end of each day.

What is the Treasury Single Account (TSA)?

One of the key policy initiatives of government is the Ghana Treasury Single Account (TSA)— a set of linked bank accounts through which the government recognises all its receipts and payments and obtains a consolidated view of its cash resources at the end of each day.

Established under the Public Financial Management Act, 2016, (Act 921), TSA is a unified structure of government bank accounts which enables the consolidation and optimum utilization of government cash resources.

TSA is, therefore, meant to provide the government with a consolidated view of its cash resources and to ensure efficient treasury management as required under the cash management reform initiative.

Under the law, the Controller and Accountant-General is mandated by the Minister for Finance to implement the TSA which requires the transfer of the bank accounts of all government institutions to the Central Bank for ease of management and monitoring.

It was launched in 2017, with the expectation to contribute to the improvement in treasury operations and consequently facilitate better service delivery.

TSA implementation plan

In a statement by the Minister for Finance, Ken Ofori-Atta, Atta, a TSA Implementation Team was constituted to oversee the process of implementation.

It comprised staff from the Bank of Ghana (BoG), Controller and Accountant-General’s Department (CAGD); and a Working Group within the Ministry of Finance (MoF) to facilitate the process.

The team, he said, had also agreed on a roll-out plan to transfer bank account balances to BoG by opening new accounts at BoG, transferring and closing the bank accounts at the commercial banks, closing excess accounts at BoG and initiating an intra-account transfer at BoG.

Commercial banks’ concerns

The successful implementation of TSA depends, to a large extent, on the strong support of commercial banks and other financial institutions.

Some, however, raised issues over the closure of government’s accounts, arguing that it would drain liquidity in the banking sector.

Funds lodged with them have been borrowed and as such transferring these balances and any action requiring the transfer of these accounts without settling the indebtedness will severely jeopardise the banks.

The banks further stated that they are saddled with the effects of delayed payments related to government projects and these delays are relatively compensated for by banks’ engagement in managing government revenue

Furthermore, “the banks have said a significant portion of funds they are being requested to transfer to the central bank have been advanced as credit mostly to other government institutions and related government projects with overdue repayments”, the banks said in a statement cited by the B&FT in July 2017.

Since then, an effective engagement between the two parties seems to have gone well with well almost 2000 bank accounts successfully closed.

Progress with TSA

Early this year, finance minister Ken Ofori Attah revealed at the Parliamentary Select Committee that government has managed to close down 1,985 of its accounts out of the 4,000 it holds with some banks.

Following the closures, the monies have been successfully transferred into a single account at the Bank of Ghana.

This is to enable the government to manage its funds better to ensure fiscal prudence and also meet a requirement by the International Monetary Fund (IMF).

It is also expected to prevent the situation where the government’s funds lie idle with the commercial banks, while it sometimes borrows the same funds from the banks with an interest to finance the budget.

Second Phase

At a durbar with staff of the department in Kumasi, Mr Ofosuhene revealed that the second phase of the exercise will begin soon and will include Metropolitan, Municipal and District Assemblies (MMDAs) and other State Owned Enterprises (SOEs).

The first phase involved largely the closing down of bank accounts of the Ministries, Departments and Agencies.

Myjoyonline