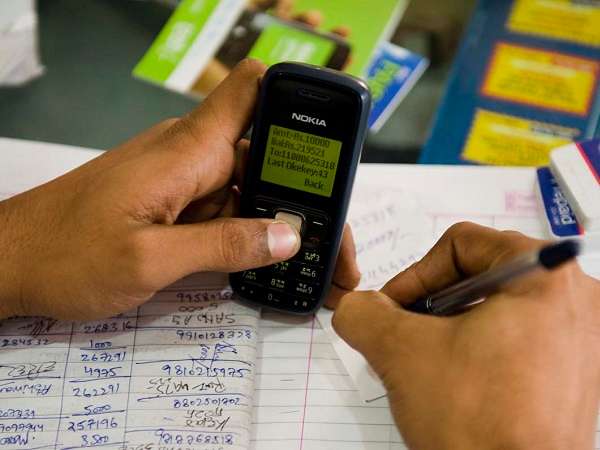

About GH¢13 billion is accrued from mobile money transactions every month, making Ghana the leader in West Africa, according to the World Bank Global Findex Survey 2017 Report.

82 million transactions are also realized daily from mobile money transactions while the number of registered and active mobile money agents presently stands at 151,000, about 25 percent increase since 2012.

Buddy Buruku, who is in charge of Digital Markets, said the substantial progress made by the country in mobile money services has seen Ghana catching up with Tanzania which is 7th ranked in Africa.

Kenya is still the leader in Africa with nearly 80 percent of adults made or received digital payments which is almost twice the developing world average of 44 percent of adults.

According to Mrs. Buruku, “the regulatory revision of the financial services act to give more priority to payment systems have contributed to the growth of mobile money services.”

The survey revealed that 85 percent of mobile money agent growth happened after the promulgation of the law. 71 percent of active account growth and 79 percent of transaction volume growth also took place after the law had been amended.

Mrs. Buruku emphasized that there was no indicator to suggest that banks were suffering from the growth of mobile money services, adding banks should rather take advantage and grow their digital banking.

She added that mobile money services should be expanded to include agric payments, investments, remittances, utility payments, merchant payments, government payments and school fees payments.

Meanwhile, Ghana has become a success story in terms of financial inclusion over the last six years, as the share of adults with access to formal financial services account in Ghana grew from 29 percent in 2011 to 58 percent in 2017, the Findex Report revealed.

But this is largely derived from mobile money accounts as about 42 percent adult Ghanaians have mobile money accounts compared to about 16 percent having traditional accounts.

However in Nigeria, more than 30 percent of adults have bank accounts with traditional banks.

Globally, only about 4.0 percent of people have mobile money accounts. The story is however different in Sub Sahara Africa whereby 21 percent of people own mobile money accounts.

In Ghana, the gender gap is also about 8.0 percent. 52.0 percent of adult males have accounts compared to women.

Unbanked

According to the report, 45 percent of unbanked adults in Ghana have mobile phones.

Lack of enough money, lack of documentation and proximity of banks were cited as reasons of not having accounts in Ghana. 300,000 unbanked adults in private sector jobs however are paid with cash.

Agriculture

In Ghana, 25 percent of adults received agriculture payments, with almost half of them into accounts. The report noted that Ghana, Kenya, Uganda and Zambia are making huge strides in this area

Also, 1.4 million unbanked adults however receive agric payments via cash. 68 percent have mobile money accounts.

Credit

Only 40 percent borrow money in Ghana and mostly do so from family and friends.

The report said this was expected to change with the improvement in address system.

The 2017 Global Findex database shows that 1.2 billion adults have obtained an account since 2011, including 515 million since 2014. Between 2014 and 2017, the share of adults who have an account with a financial institution or through a mobile money service rose globally from 62 percent to 69 percent.

In developing economies, the share rose from 54 percent to 63 percent. Yet, women in developing economies remain 9 percentage points less likely than men to have a bank account.

The Global Findex database is the world’s most comprehensive data set on how adults save, borrow, make payments, and manage risk.

Launched with funding from the Bill & Melinda Gates Foundation, the database has been published every three years since 2011.

TheFinder