For West African farmers, crops in the field doesn’t necessarily translate to money in the bank.

With the recent end of the rainy season across the sub-region, farmers face the stark choice of being stuck with perishing excess produce or selling it at low prices to clear their inventories.

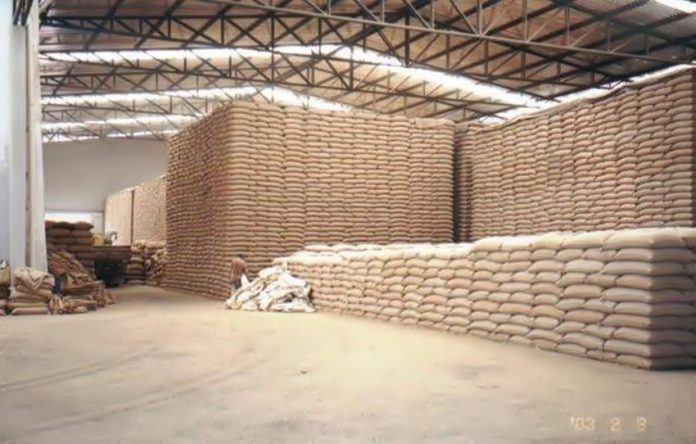

One proven solution to this dilemma is warehouse receipt financing (WRF). This system allows farmers and smaller agribusinesses to use agricultural goods stored in certified warehouses as collateral to access credit from financial institutions.

It’s a system that benefits players along the entire agricultural value chain, including farmers, cooperatives, processors, traders, warehouse operators, bankers, and consumers. Millions of tons of agricultural products transit through the warehouse receipt systems of South Africa and India, with billions of dollars lent against goods in storage in the latter country. But to establish WRF requires the public and private sectors to pull together to enact policy changes, develop storage infrastructure, and empower private actors.

To help speed this intricate process in West Africa, IFC, a member of the World Bank Group, recently convened more than 100 agribusiness representatives, bankers, insurance brokers, regulators, and warehousing and collateral management service providers from the region for discussions in Accra, Ghana.

Although participants universally affirmed their commitment to WRF, they lamented the lack of progress launching the system in the region, identifying four hurdles that need to be cleared:

1. Legislation. For the system to work, governments must pass laws and regulations to formalize the use of the warehouse receipt as an instrument of trade and financing of goods in storage. Côte d’Ivoire, Ghana, Niger, and Senegal, among others, have made progress introducing a legal and regulatory framework for warehouse receipts and in creating institutions to supervise and support this system—but more needs to be done.

2. Quality certification. It is in the interest of warehouse operators to ensure that agricultural products they receive meet certain minimum quality standards. Producers must look to produce the quality products that the market expects. If quality assessment is not properly managed when goods enter a warehouse, buyers may lose faith. Therefore, quality standards need to be established and accepted by actors along the value chain for both agricultural goods and proper warehousing practices.

3. Infrastructure. The WRF system only works if farmers have ready access to warehouses. Governments and the private sector should explore ways to encourage investors to build in rural or isolated areas.

4. Harmonization. Regional integration is a priority objective for West Africa, so harmonized approaches to WRF development should be pursued where feasible and appropriate, while respecting the unique features of different markets and value chains.

IFC has successfully helped Cote d’Ivoire, Ghana, Kenya, Malawi, Senegal and other countries establish the foundations for warehouse receipt financing. Agricultural actors working with cereals and grains such as maize, sorghum, and rice, and cash crops such as cashew, groundnuts, and cocoa stand to benefit from this mechanism.

Through the Invest West Africa Warehouse Receipt Regional Program, IFC is poised to help governments introduce and implement warehouse receipt financing, in hopes of benefitting hundreds of thousands of farmers and the growing number of agribusiness SMEs blossoming across the region.