Challenges in the banking sector, which started last year and resulted in the closure of some banks, have so far cost the country GH¢9.9 billion, Finance Minister, Ken Ofori Atta, has revealed.

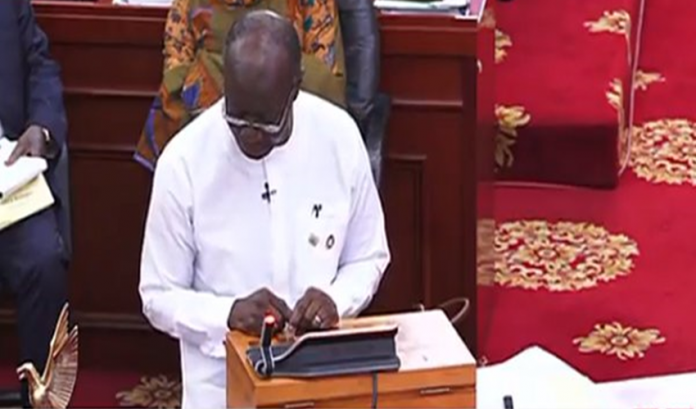

Presenting the 2019 budget to Parliament on Thursday, the Minister said it was important for some seven banks that were closed down between 2017 and 2018 to exit the financial system to keep the entire sector from total collapse.

“Rescuing the situation regarding these banks has so far cost some 9.9 billion Ghana cedis in monies government has not budgeted for and would surely could have put in good use to fix our numerous infrastructural needs – roads, bridges, housing et cetera,” he said.

The Consolidated Bank, a creation of the central bank, has since taken over the assets and liabilities of the five banks because of various infractions of the banking law.

Commenting on the financial sector crisis during the 2019 budget presentation, the Finance Minister told legislators that the bold decisions taken by the new administration of the Bank of Ghana have been good for the entire economy.

“Since the assumption of office by the current administration of the Bank of Ghana, bold measures have been taken to restore the health and resonance of the banking sector and to clamp down on unlicensed deposit-taking financial houses,” he said.

DKM

Touching on the collapse of yet another financial institution in 2016, the Minster provided figures thatsuggest that almost all of the depositors whose money were swallowed following the company’s collapse have been settled.

“An additional 12,612 claims have been fully provided for, but the customers have not as yet been able to show proof of deposit. This means that 92 percent of DKM claims from depositors have been paid or provided for. Depositors for the remaining 7,568 claims of above,” Ken Ofori Atta stated.

The DKM Diamond Microfinance Limited was alleged to have invested about GH¢77 million of its customers’ deposits in its subsidiary companies – DKM Airlines Company, DKM Fuel Station, DKM Transport, DKM Shea Butter Company and DKM Mining Company, among others.

The microfinance company’s license was revoked in February 2016.